Global wine trends and trade shows

Alcohol-free wines, Easy drinking, canned Spritzer, vegan or organic wines – all these are relevant keywords in the latest trends of the wine industry. While the general number of wine consumption decreases, the number of non-drinkers, environmentally and health conscious people is on the rise. By now, many wineries have adapted to these new patterns and are exchanging their novelties worldwide. In the course of this, wine trade fairs have become more and more valuable, since they are great ways for networking, building brand recognition and spotting new trends.

New players shape the industry

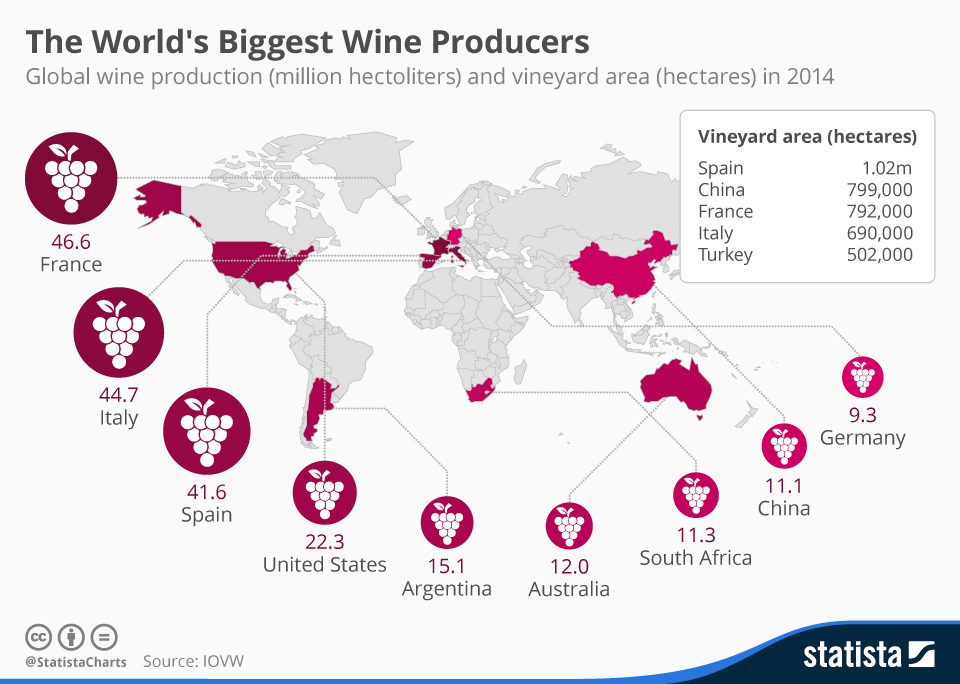

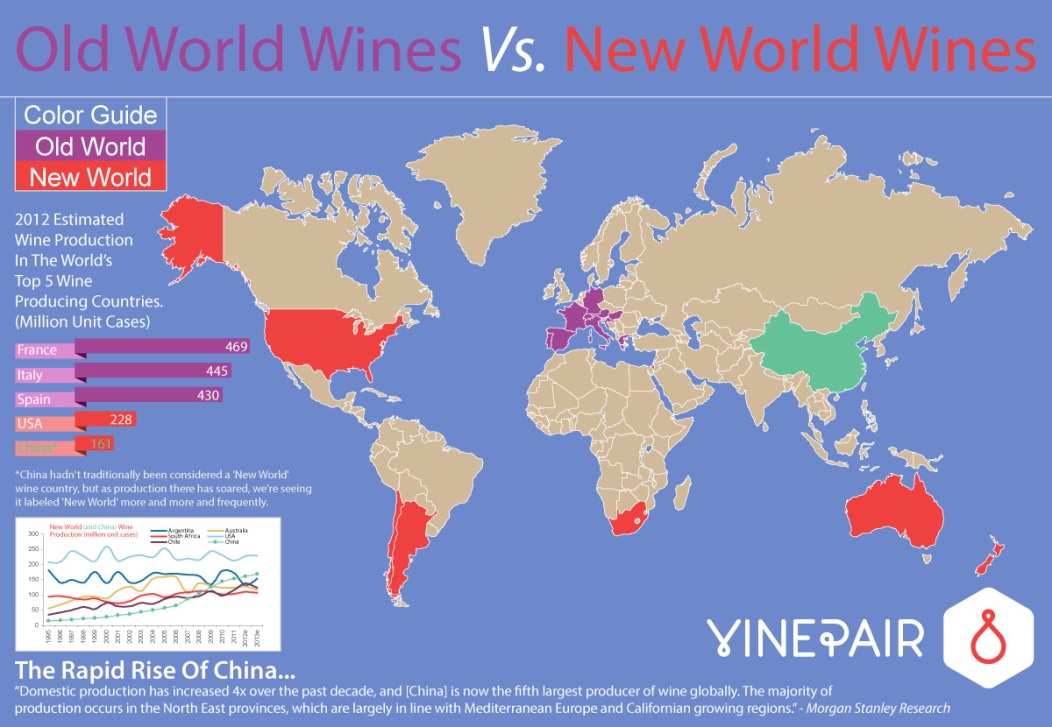

France, Italy and Spain have long been well-known players in the wine industry. Within the past years, however, the scene in this sector has drastically changed: Countries of the “New World”, including Chile, Australia, South Africa and Argentina, have stepped up to top positions. Nevertheless, it is China that has developed the most, not only in terms of production but also regarding consumption. And the trend is about to continue. This nation makes up for the world’s largest importer of wine and the growing consumer base makes it an attractive place for growers. Also trade shows have adapted to this change in the industry and besides the major fairs in Europe, also other continents like Asia and America become more and more interesting and interested in hosting trade events.

The major trade shows for viniculture are:

Vinitaly, Italy

Italy is not only the country producing the highest quantities of wine, but also the host of the largest wine trade show worldwide: Bringing together more than 4.000 exhibitors and 128.000 visitors from 143 countries (2018), Vinitaly takes place once a year in Verona, Italy. The next chance for guests to take part at conferences, workshops, tastings and other events is from April 7th-10th, 2019.

ProWein, Germany

Germany’s major wine exhibition ProWein also has the reputation to be one of the world’s leading networking events. It is the number 1 meeting place for professionals from viticulture, production, trade and gastronomy. In 2018, 6.681 exhibitors presented their wines to more than 60.000 visitors. By now, the fair itself has expanded to the global level and experts from the wine industry can visit ProWine China in Shanghai (November 13th -15th 2019) or ProWine Asia, either in Hong Kong (May 7th-10th, 2019) or Singapore (2020). In Europe, the next edition happens March 17th-19th, 2019 in Düsseldorf.

Vinexpo, France

Since 1981, Vinexpo has connected experts of the wine industry to boost sales and stimulate the market. Taking place in Bordeaux (May 13th-16th, 2019), Hong Kong, Tokyo, Miami and Paris (2020), it is the only trade event of the wine and spirits sector that takes place on all three continents with the highest consumption rate. The new format “Vinexpo Explorer” is an exclusive event to promote one specific region with high potential each year.

ExpoVinis, Brasil

South America’s biggest wine show ExpoVinis takes place in São Paulo, Brazil and is often the market entry point for wine producers from abroad. Various countries from South America, like Chile and Argentina, count to the New World in wines and their importance should therefore not be underrated. The next edition is taking place June 11th-14th, 2019.

Asia

Besides ProWine and Vinexpo, also the Hong Kong International Wine & Spirits Fair (HKTDC) might be interesting for insiders of the sector. The HKTDC is one of the most influential Asian Wine trade fair that brought together nearly 20.000 trade buyers and many more public visitors in 2017. How many people will join the fair from November 7th-9th, 2019?

Good Food & Wine Show, Australia

Several times every year, the Good Food & Wine Show can be visited in Australia. Melbourne, Sydney, Perth and Brisbane all open their doors to display the latest trends of the wine industry.

More related information:

Vinisud and Vinovision 2019, two major French wine shows

The organic wine market in France

Our service of accompaniment at fairs

Vinisud 2018, the French trade-show of the Mediterranean wines

Case of success: The internationalisation of Singular Spirits’ artisanal spirits