The French gardening market

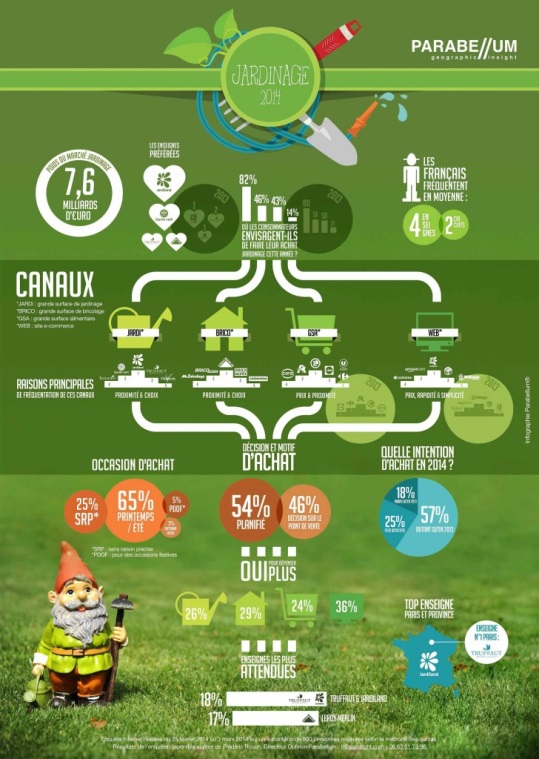

The market of the private gardening represents in France 7.600 million euros in 2014

Habits of the French consumer

The French consumer buys 82% of the equipment in large gardening areas (such as Gammevert, Jardiland, etc.) prefers proximity and choice. Secondly, the large DIY areas (such as Mr. Bricolage, Leroy Merlin, etc.), with 46%, for the same reasons.

Leclerc, Super Uno or Auchan type supermarkets reach the third place with 43%, mainly for price reasons, and finally reach the web with 14%, in commercial places, due to their simplicity. In 54% of cases, the purchase is already planned by the customer, and 65% of the time you buy in the spring or summer. In 29% of cases, customers are willing to buy more than they came to buy. The most visited chains by customers are Truffaut, Jardiland and Leroy Merlin.

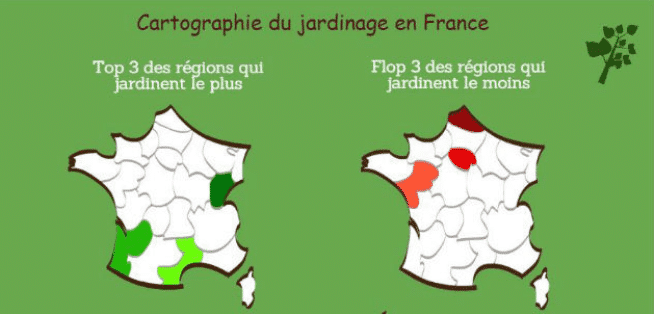

The areas where the population feels most passion for gardening is that of Franche Comté, Languedoc Rosselló and Aquitaine. On the other hand, the less important gardening areas come from North of Calais, Ile de France and Pays de la Loire.

The distribution channels

The French market of gardening has registered an annual average growth of 1% during the last decade. This global performance makes evident the disparities between the distribution channels:

– The circuits that have been able to exploit promising background trends (development of environmental sensitivity, increasing the attention of the French to their garden considered as a living room where they invest) show an above-average growth. This is the case of the gardening centers that benefit from the dynamism of outdoor plants, are developed in the related segments and are reinforced in green leisure and GSB that are positioned as multi-habitat / decoration specialists;

– Other channels have less than average growth. GSAs stagnate, sanctioned by a predominantly price-based approach, a reduced supply and a shortfall in the areas of supply and development of advice / service. Motoculture specialists have experienced a decline in sales in recent years as a result of the crisis.

Expansion and diversification of the offer, modernization of concepts

The challenges for distributors are:

– Improve the attendance rate of points of sale. This requires an extension of the offer to the garden but also the opening in other universes (pet store, decoration, outdoor recreation, even eating, textile …);

– Quickly adapt the offer to the effects of fashion and weather conditions;

– Capture novice gardeners by offering ready-to-use products because the garden is not a restriction (kits, custom planters, etc.);

– Increase customer loyalty. The signs seek to cultivate an “expert” positioning by the board (at the point of sale and through its website) and the services (diagnosis, soil analysis, guarantee, freight assistance, etc.);

– Offer attractive prices. In this perspective, the development of the white label is an important strategic focus. This is especially so, if the struggles of low cost to prevail (see the failure of DockJardin), the GSA develops the concepts dedicated to the garden (Jardi @ E. Leclerc, The Gardens of Auchan) and pure Internet players (Cdiscount, Rue takes Commerce) is positioned to the market.

The concentration of the sector

It is characterized by the great heterogeneity of chains and groups in terms of economic weight, size of the network and geographical coverage. This configuration favors a concentration movement, but operators will have to choose between internal or external growth to develop their network given the cost of these operations.

This movement would have to have as a result:

– new reconciliations between central and independent networks (measurement effect, increase in bargaining power);

– the absorption of some networks of insufficient measurement or regional ladder;

– the rise of leading brands with a consolidated reputation and sufficient financial margins to finance the development strategy;

– the decrease in the number of independent centers and lodges that constitute so many objectives for retailers and groups.

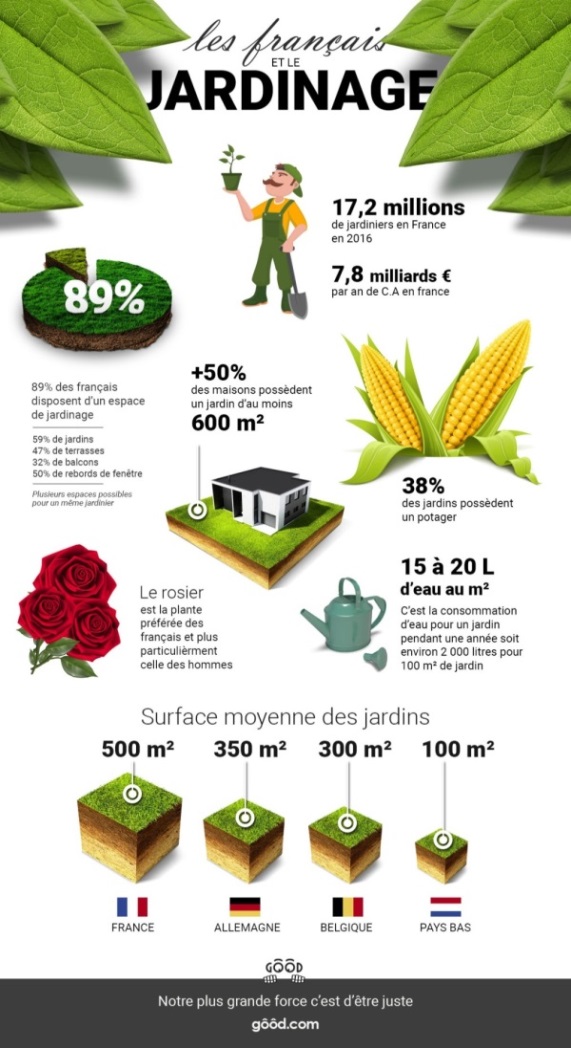

In France, 17.2 million people live in houses regularly. More than half of the houses have a garden area of at least 600 m², and 89% of French people have a gardening space at their home. The median surface of the garden is the highest in Europe, and with a median surface area of 500 m².

Other related links:

The packaging industry in France

Business opportunities in the home décor sector

The export of the promotional object in France

The exportation of the decoration sector to France

The organic wines market in France

The market of organic products in France